You may also have a look at the following articles to learn more-Finance vs Economics Asset Purchase vs Stock Purchase. Preference Share Capital.

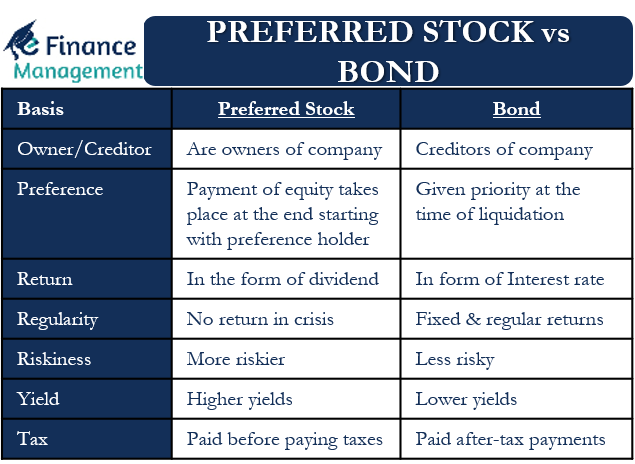

Preferred Stock Vs Bond Meaning Differences And More Efm

This will involve issuing B Shares to Shareholders at a ratio of one B Share for each Existing Ordinary Share held and then redeeming the B Shares for a fixed amount per B Share.

. The key difference between Common and Preferred Stock is that Common stock represents the share in the ownership position of the company which gives right to receive the profit share that is termed as dividend and right to vote and participate in the general meetings of the company whereas Preferred stock is the share. Valuation of Ordinary Shares. A share denotes a claim on a corporations ownership or interest in a financial asset.

The rights attached to ordinary shares are generally defined in the articles of association of the company andor in the shareholders. Holders received 10448 for each Shell Transport First Preference share held comprising. Class A shareholders generally have.

Equity Share Capital is the funds that a company has generated by issuing Equity shares. Convertible securities in the companys financial structure. For each Royal Dutch ordinary share held in bearer or Hague registry form tendered.

The difference between Class A shares and Class B shares of a companys stock usually comes down to the number of voting rights assigned to the shareholder. On the other extreme diluted earnings per share are computed when there are potential shares ie. Worked example of tax position.

It is certainly a tax-effective method to increase shareholder value and share price by diminishing the total outstanding shares. Ticker and ISIN codes the difference between A and B shares information about our ADS facility frequently asked questions and historical listing archive. Ordinary Shares Preference Shares Bonus Shares Sweat Equity and Employee Stock Options ESOPs.

Spring Limited grants options to Mr Lamb over 1000 shares with an exercise price of 1 per share. Overview of Altman Z Score. These types of.

These types of shares are sans any maturity date. OCBCs issued shares including treasury shares as at 3 March 2022 was 4514762999. Equity shares are the ordinary shares of the company.

A stock is a type of security that signifies ownership in a corporation and represents a claim on part of the corporations assets and earnings. Jpaugh If I am a class consumer I follow contracts set by the class creator. We reformulate expected utility theory from the viewpoint of bounded rationality by introducing probability grids and a cognitive bound.

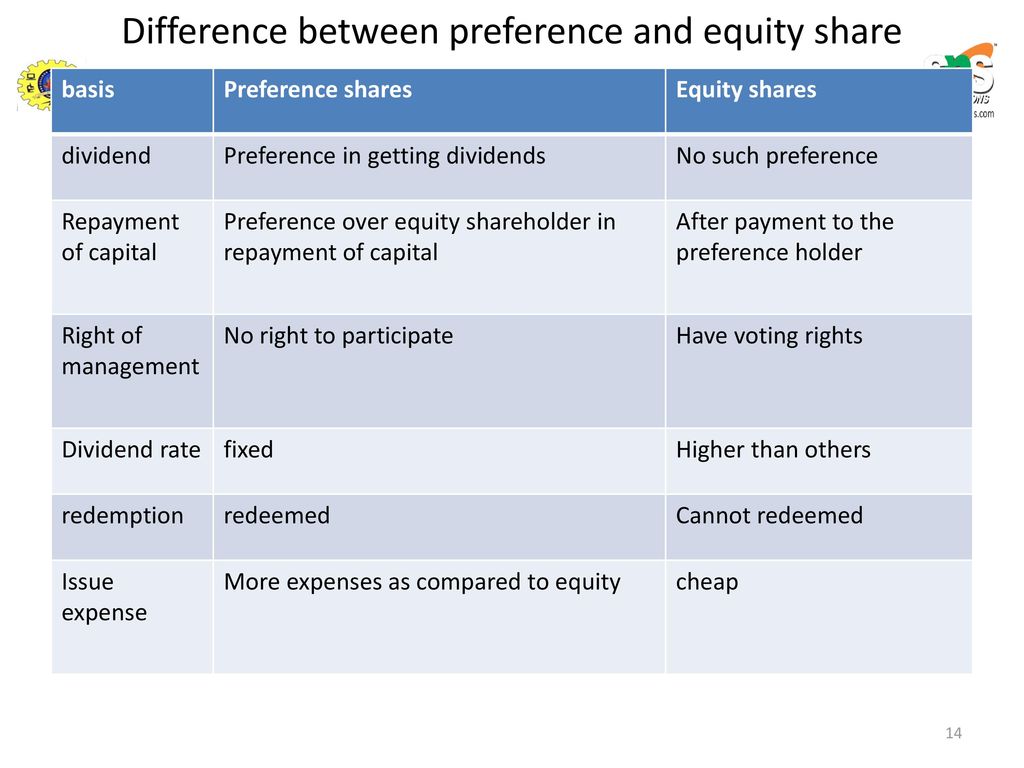

Basic Earning Per Share is the ratio that is reckoned to know the earnings available to each equity share. The holder of the equity shares are the real owners of the company ie. A company can repurchase or claim redeemable preference share at a fixed price and time.

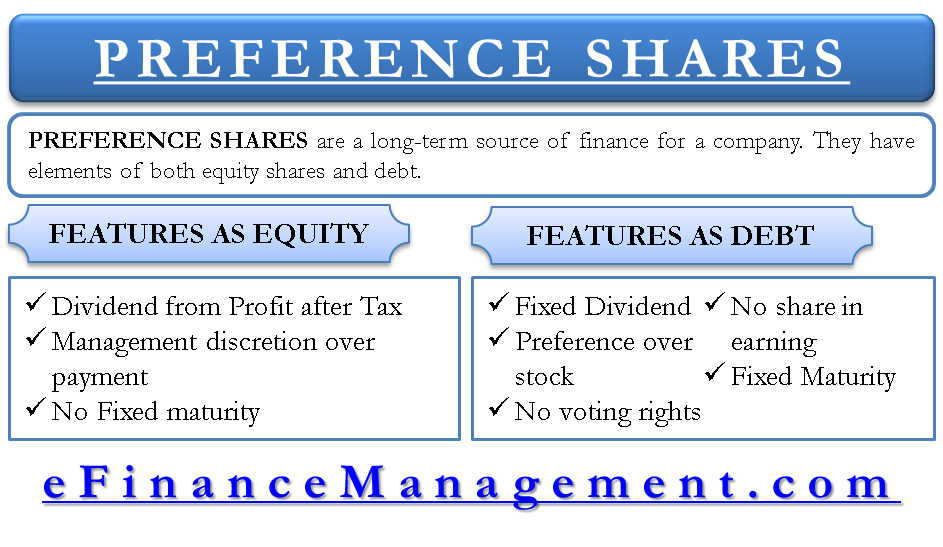

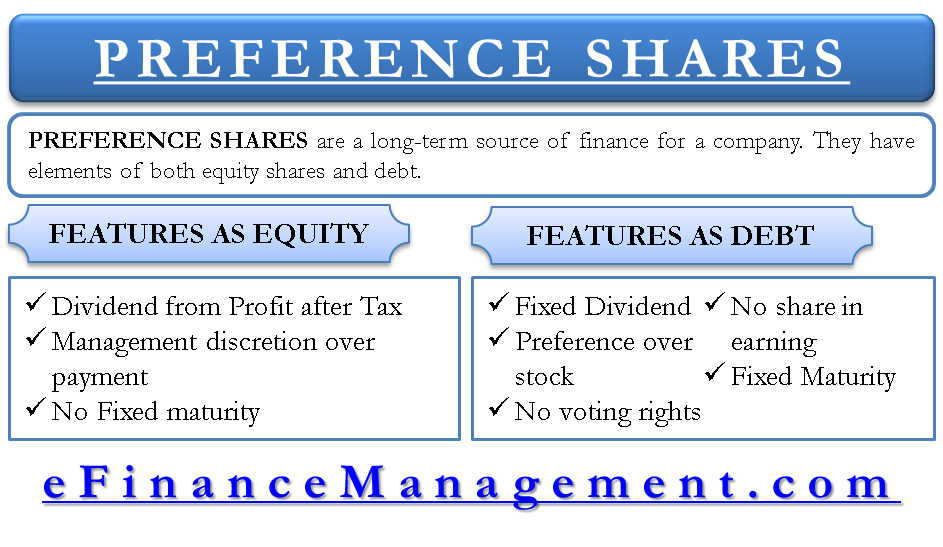

ORMapper but the fact remains that string is a lexical construct of the C grammar whereas SystemString is just a type. Differences Between Common and Preferred Stock. Preference Share Capital is the funds that a company has generated by issuing preference shares.

Assign any numbers within the limits of DateTime which I can look upIf the creator adds constraints to the setters those constraints are not communicated. The B Share Scheme is the way in which Aviva proposes to return 375 billion to Shareholders. Difference Between Bond and Equity.

Non-voting or growth shares. Assign any chars up to 2bil lengthIf a property is DateTime my contract is. There are three main methods for valuation of ordinary shares.

The share buyback meaning refers to the companys repossession of its shares at a cost greater than the market value from current shareholders. The amount of shares held by them is the portion of their ownership in the company. If a property is string my contract is.

Accepts any liability or responsibility whatsoever in respect of any difference between the materials or information made available to you in electronic format and the hard copy version. Warrants and options are similar in that the two contractual financial instruments allow the holder special rights to buy securities. This has been a guide to the top difference between Z score vs T score.

Now ordinary share capital of the company would be 10000 x 20 200000. Bondholders are given preference in case the. It is calculated by considering companys ordinary shares.

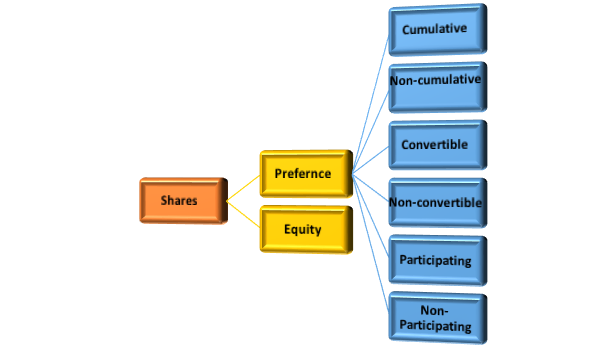

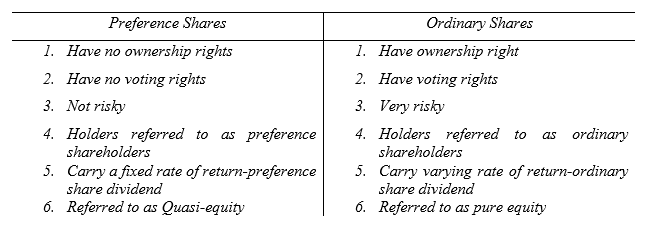

In terms of dividend vs share buyback both have different purposes and implications. Shares are commonly divided into two types known as ordinary shares and preference shares. These shares also give right to the distribution of the companys assets in the event of winding-up or sale.

Ordinary shares typically carry one vote per share and each share gives equal right to dividends. The language itself must support string in a way that the implementation is not quite so. Issued ordinary share capital.

We restrict permissible probabilities only to decimal ell ℓ -ary in general fractions of finite depths up to a given cognitive bound. They differ mainly in that warrants are. In finance a warrant is a security that entitles the holder to buy or sell stock typically the stock of the issuing company at a fixed price called the exercise price.

Definition of Equity Shares. Ordinary shares and Preference shares are distinguished from each other based on the benefits rights and features that they offer to the holders of such shares. Regardless of any explicit difference mentioned in any spec there is still this implicit difference that could be accomodated with some ambiguity.

Here we also discuss the Z score vs T score key differences with infographics and comparison table. The Dividend Rate in the case of Preference Share Capital is not changeable. Both are discretionary and have expiration dates.

The option must be over ordinary fully paid-up shares although they can be different class of share ie. Government Bonds Corporate Bonds Municipal Bonds and Asset-Backed Securities. It cannot be over redeemable or preference shares.

We distinguish between measurements of utilities from pure alternatives and their extensions to. For example let us suppose a company has issued 10000 ordinary shares and 5000 preference shares for 2 per share for both ordinary as well as preference share. Money Market vs Capital Market.

What Are The Differences Between Equity Shares And Preference Shares Quora

What Are The Differences Between Equity Shares And Preference Shares Quora

Equity Shares Vs Preference Shares Top 9 Differences To Learn

Difference Between Equity Share And Preference Share Infographics

Equity Shares Vs Preference Shares Top 9 Differences To Learn

Different Types Of Shares Ordinary Versus Preference Shares Fincor

Accounting Nest Preference Shares

Long Term Finance Shares Debentures Term Loans Leasing Ppt Download

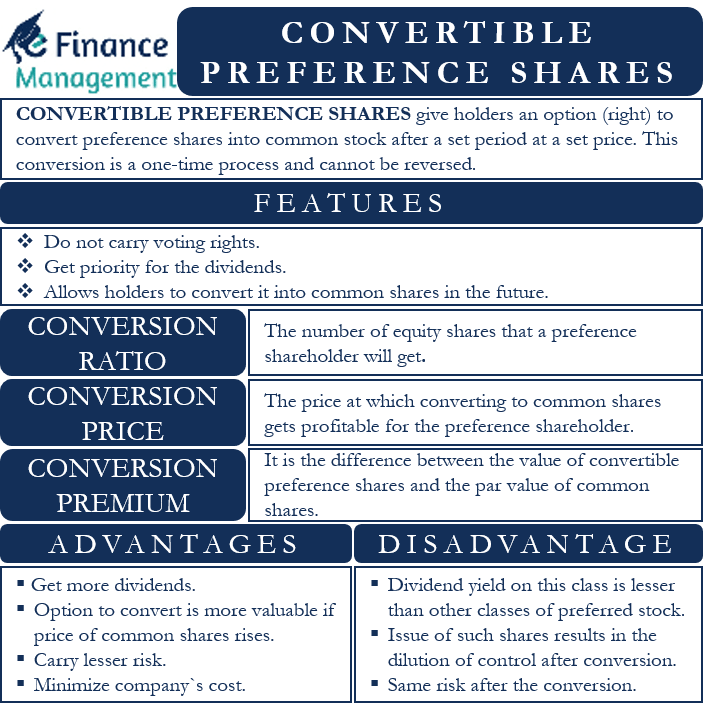

Convertible Preference Shares Meaning Advantages And More

Long Term Finance Shares Debentures Term Loans Leasing Ppt Download

Preference Shares And Its Features

Difference Between Share Capital And Share Premium Compare The Difference Between Similar Terms

Long Term Finance Shares Debentures Term Loans Leasing Ppt Download

Preference And Ordinary Shares

Common Shares Vs Preferred Shares Differences In Equity Capital

Difference Between Equity Shares And Preference Shares Assignment Point

Difference Between Equity Share Capital And Preference Share Capital